What Oscar Does

America's healthcare system spends twice the portion of its GDP on healthcare than any other rich country in the world for results that are no better - and in many instances worse. Despite its high cost, our healthcare system is full of nightmarish stories - of complex, impossible to read bills and unpredictable prices, and bad outcomes for patients.

The core issue with U.S. healthcare is that it is theoretically structured as an open marketplace, but without any of the transparency or competitive pressures that an open marketplace entails. So we end up in the worst case scenario: no universal access, high costs, and little consumer-orientation.

Oscar aims to make a healthier life accessible and affordable for all. We believe every American deserves access to affordable, high-quality healthcare that fits their life.

The Overview

- Some ideas about U.S. healthcare

It’s no secret that healthcare in the U.S is deeply flawed and inefficient. If we want to address the systemic issues within healthcare and drive innovation, the market needs to become more digital and interoperable. The core activities that an insurer performs are necessary components of the healthcare system –– but they should be simpler, more tech-driven, and API-accessible. At Oscar, we put this practice into play by unbundling the core building blocks of the insurer, to ultimately create a more consumer-centric, economic healthcare system.

We are well-positioned to deliver on this vision in large part because we have invested heavily in the modernization of the core activities of a great health insurer: sales personalization, member experience, care routing, and claims systems. We also believe in enabling a “decentralized” risk-based model that leverages the new world of APIs and interoperability by delivering brand trust, ubiquitous care delivery, personalized health incentives, and the ability to develop personalized campaigns to drive behavior change for our members. When looking at the macro level, healthcare may seem to be evolving slowly –– but we’ve been seeing meaningful shifts toward individualization, digitization, and value-based care.

The machinery we’ve been building since Oscar’s founding allows us to be uniquely suited to take advantage of these trends, power more of the system, and one day, transform the industry.

A model for why U.S. healthcare doesn't work:

(1) Financial incentives are misaligned because most healthcare services still get reimbursed as fee-for-service.

This graph breaks down organizations' reliance on fee-for-service reimbursement. The light green bar is the proportion of respondents who said over 75% of their organization's revenue comes from fee-for-service reimbursement.1

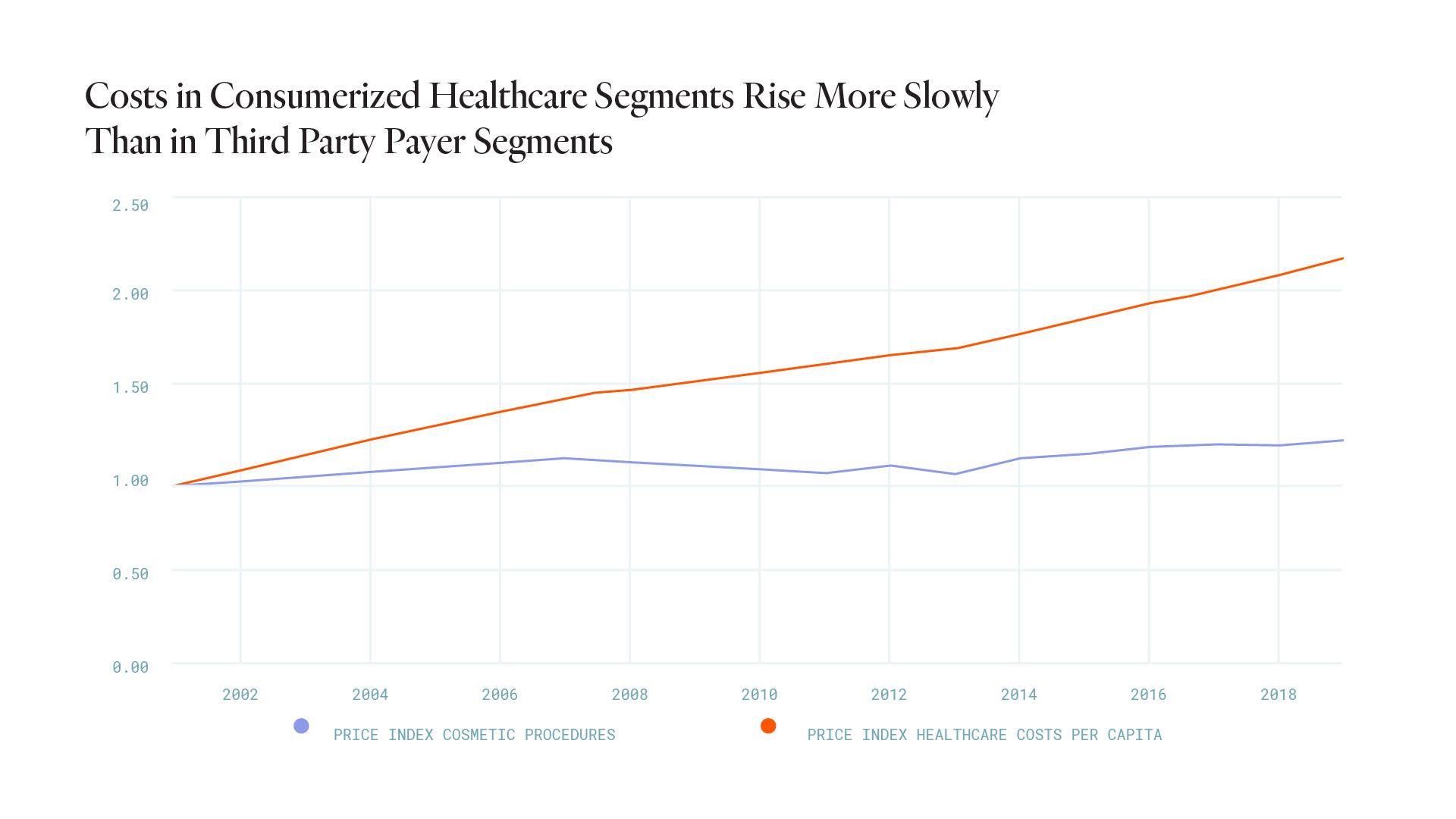

(2) Most consumers can’t vote with their feet and thus put competitive pressure on the players within the system. In entirely elective procedures, where consumers can vote with their feet, prices have developed very differently.

Inflation of cosmetic procedures 2011 - 20202

(3) As a result, cost and value don’t align: unlike in every other consumer-driven market, there isn’t as strong of a market mechanism to force costs and quality into line.

- The average insurance member tenure is ~3 years3

- Private payers spend $27.1B a year on marketing and sales, while hospitals and physicians only spend about $3B.4

- With an average Net Promoter Score, or NPS, of three, according to Forrester Research, customer satisfaction for health insurers ranks among the lowest of any industry. For comparison, Oscar's NPS is 40.

We believe that healthcare today is not structured to incentivize the build of great tech solutions that will eliminate inefficiencies and allow for more of a consumer focus.

This chart represents the percent deviation to the average of total app downloads by membership as of December 31, 2020 from App Annie and regulatory filings.

Insurers are needed for four core things.

They do four things that are critical within the system:

One

Insurers acquire premium revenue.

They are sales engines of risk in today’s healthcare system. Today, that mostly means building sales pipelines into HR departments and managing brokers and general agencies.

TWO

They identify and reduce risk per member.

Today, that means underwriting, capturing risk scores, and making limited wellness investments in members.

Three

They guide people to appropriate care.

Today, that means using either authorization (prior authorization, utilization management) or persuasion (customer service) to steer people to the right care.

Four

They manage cost of care delivery.

Today, that means contracting a provider network without gaps and at competitive unit costs.

For us, the two activities of building a great insurer and unbundling it are synergistic.

Unbundling the health insurer into 4 core components is a direct evolution of modernizing the 4 core activities of a great health insurer. We can build a piece of technology once, and use it twice - to grow our own risk business, and to help others build/grow theirs.We are unique in our approach because we put the member experience first. Our overarching belief is that in a consumer-centric healthcare market, the company offering the lowest predictable total cost of care with the best member experience wins. So, improving the Oscar experience is core to our business model. When people have a better experience - armed with more confidence about the choices they are making - they can save money and become healthier.In summary, we aim to be a great health insurer focused on the member, unbundle the core building blocks of an insurer, and let others in the healthcare system build on those to create a more consumer-centric, economic healthcare system.Modernizing the core activities of a great health insurer

These are the components we have built for our insurance business:- Better Sales Personalization

- Differentiated Brand VoiceWe build member trust through a differentiated brand voice that results in reliable member engagement, no matter their health status or background.MyIdentity is functionality that allows all members – including those who identify as transgender or non-binary – to freely input their name, pronouns, and gender identity in the Oscar experience as a part of the company’s ongoing efforts to ensure that members get the access to care they need in an equitable way.

- On a weekly basis, almost a quarter of our members engage with one of our outbound communications.

- ~25.6% of our active brokers pay their clients’ bills through the broker portal, giving us a direct and regular communications link to them.

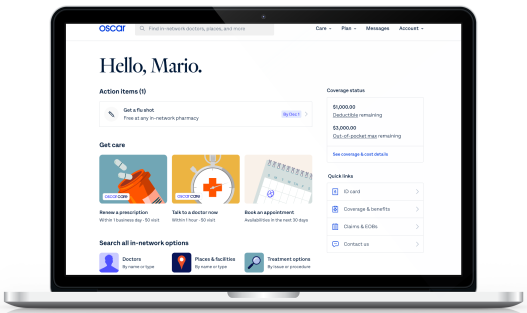

- Better Member Experience

- Digital ExperienceWe've developed a digital experience that is easy-to-use for members so we can maximize the share of healthcare shaped by Oscar. Oscar’s member app is designed to help our members with common healthcare problems by providing the kind of simple, straightforward experience consumers expect.

- 47% of our members are monthly active users.

Tech-Enabled Customer ServiceOur technology weaves clinical and non-clinical conversations in a single platform for members.

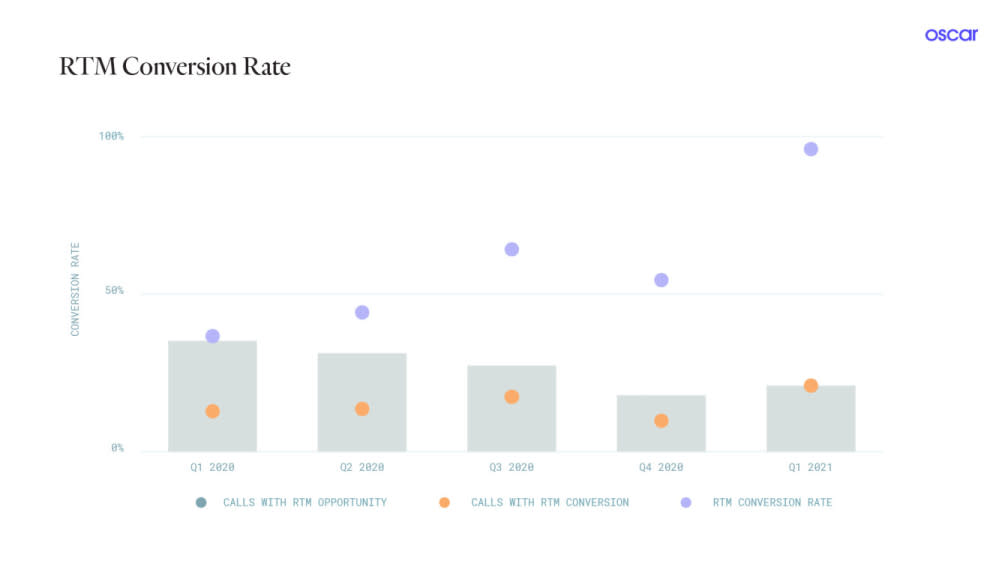

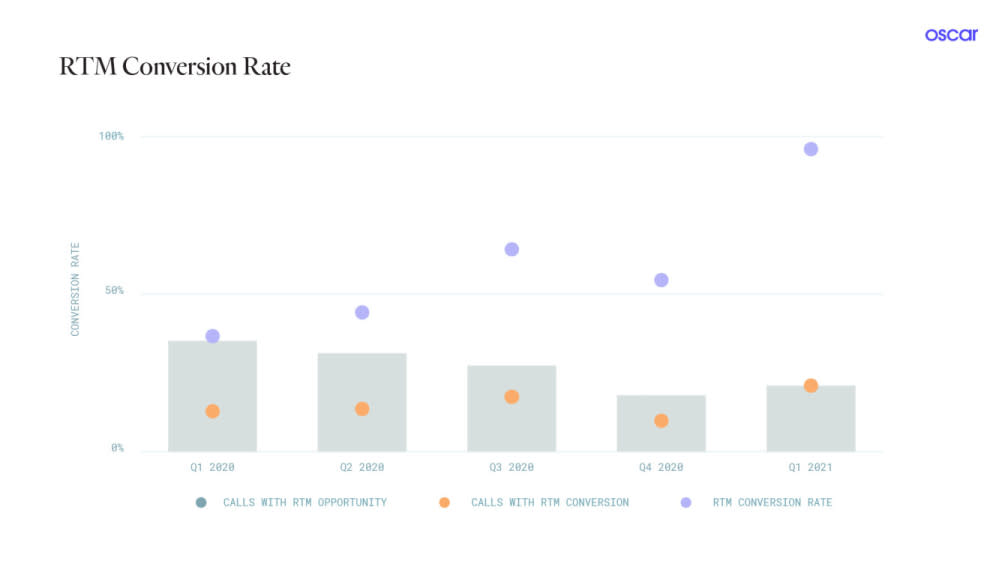

Tech-Enabled Customer ServiceOur technology weaves clinical and non-clinical conversations in a single platform for members.- Our custom-built CRM tool to support our Care Team, Rosco, is a comprehensive management platform that empowers teams as they guide members on the path to better health. Handling member, provider and facility data sources, Rosco provides care guides with key insights to meet our members’ needs every step of the way. RTM (real-time task manager) is our Care Guide intervention platform that provides recommendations to the Care Guide for the member who is calling in.

- Better Care Routing

- Care Routing Machinery We help members find the best providers for them, with clear line of sight into quality and cost.Our care routing tools recommend the best providers at the most affordable price to our members. The underlying algorithms use provider performance and personalized patient data to guide patients toward the providers and care options best suited for them, based on member satisfaction, care quality and cost efficiency. High member engagement is a necessary precursor to do this well.

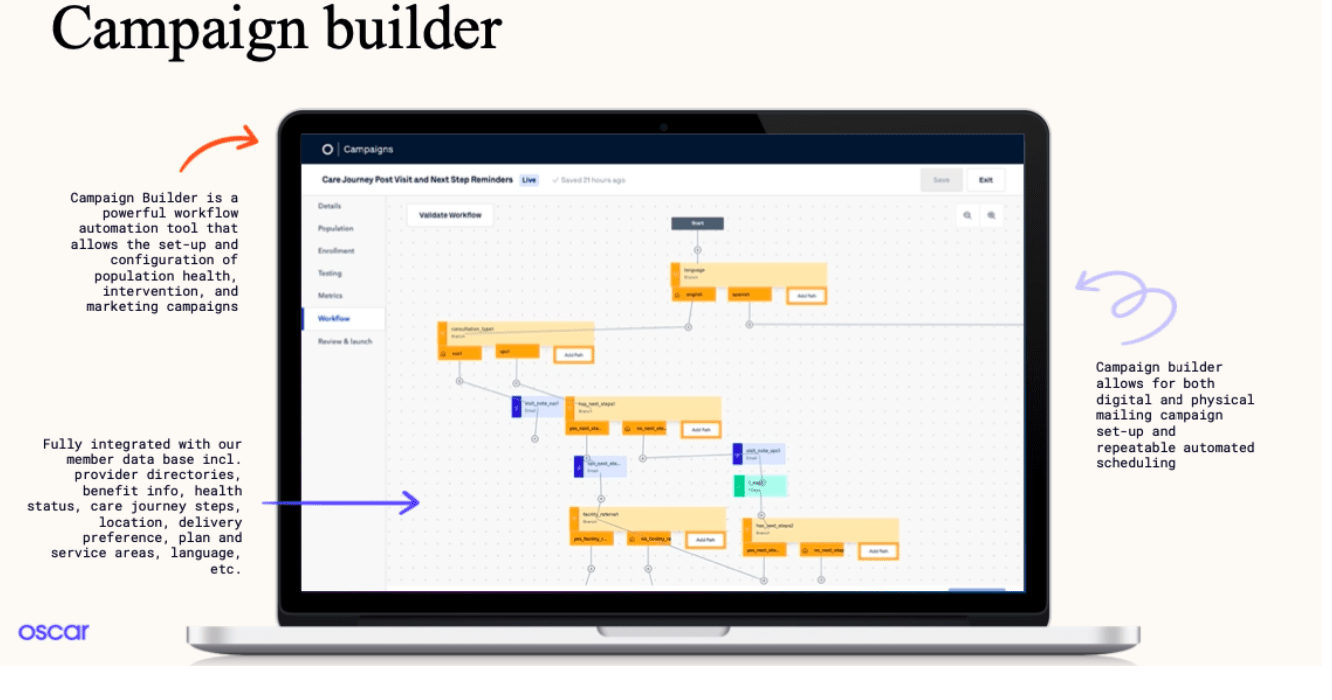

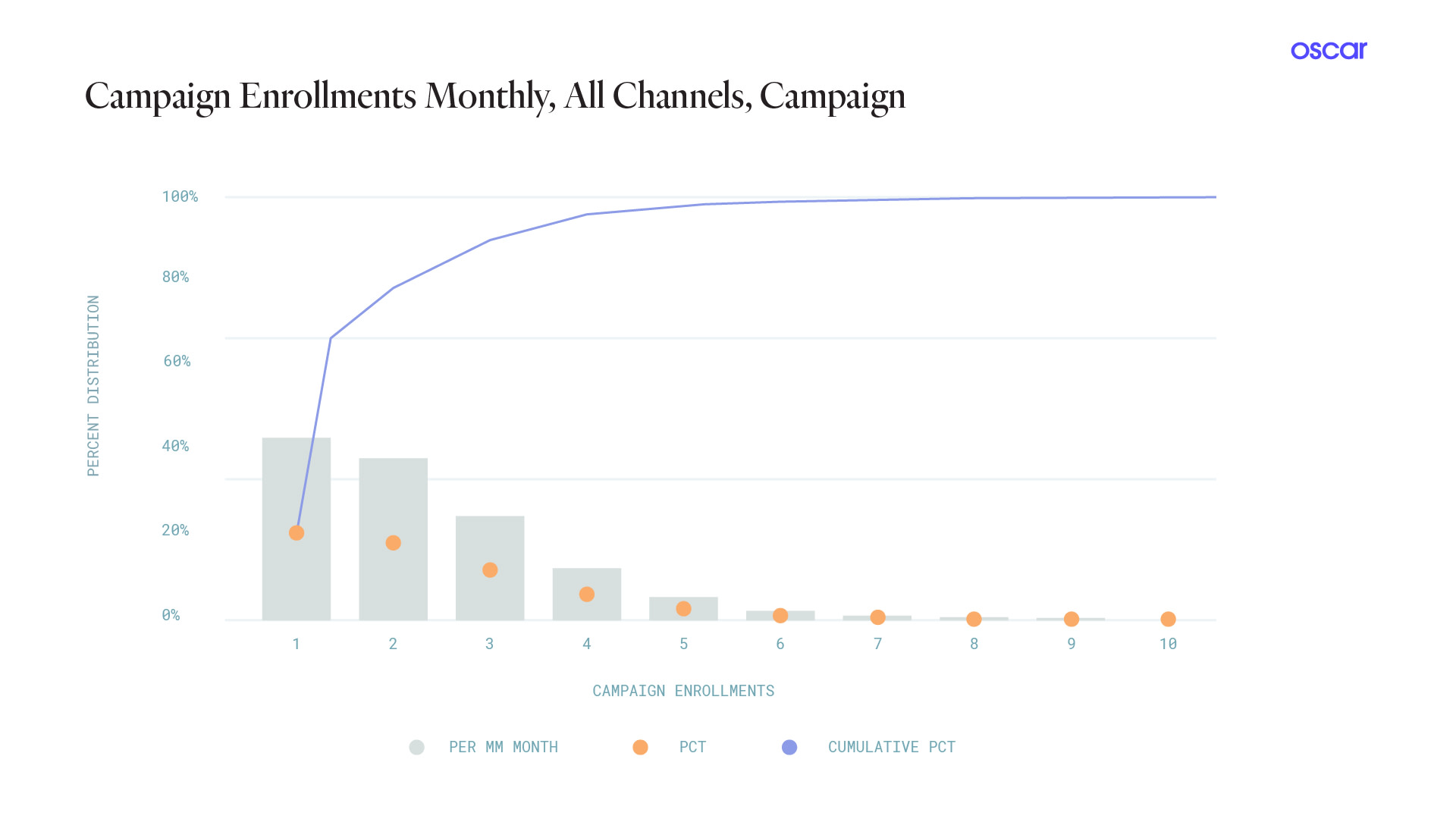

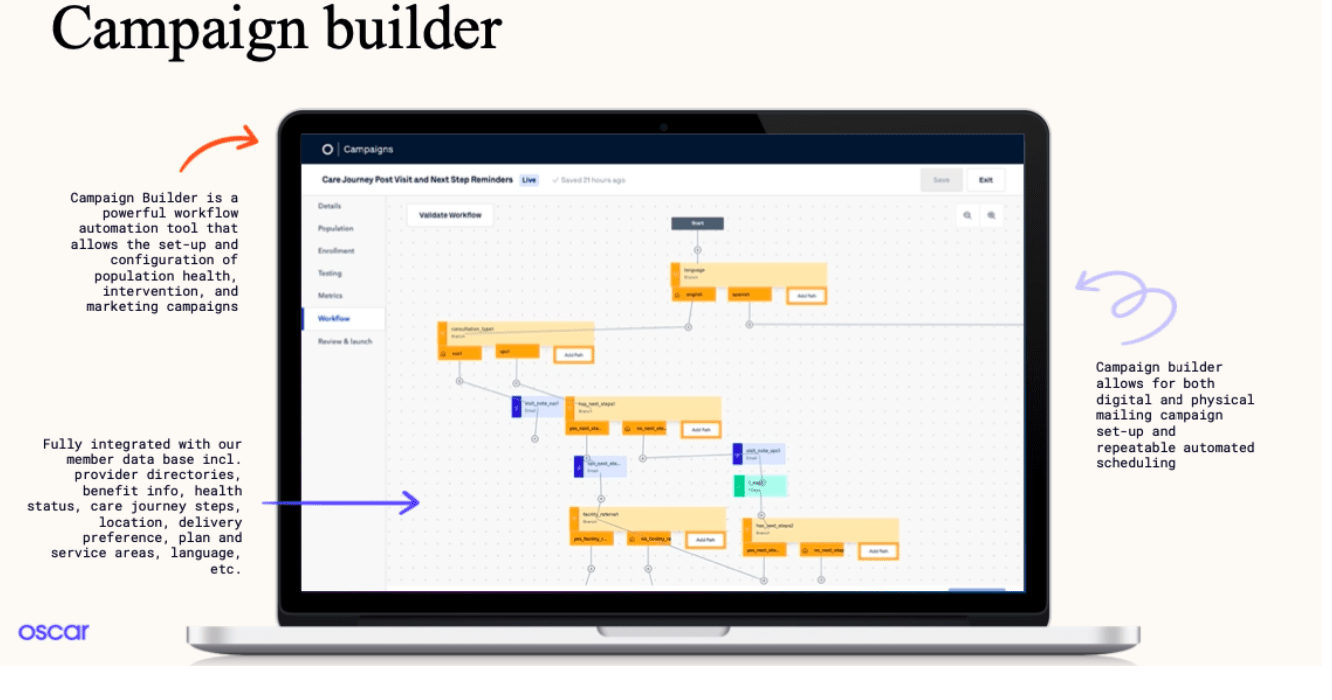

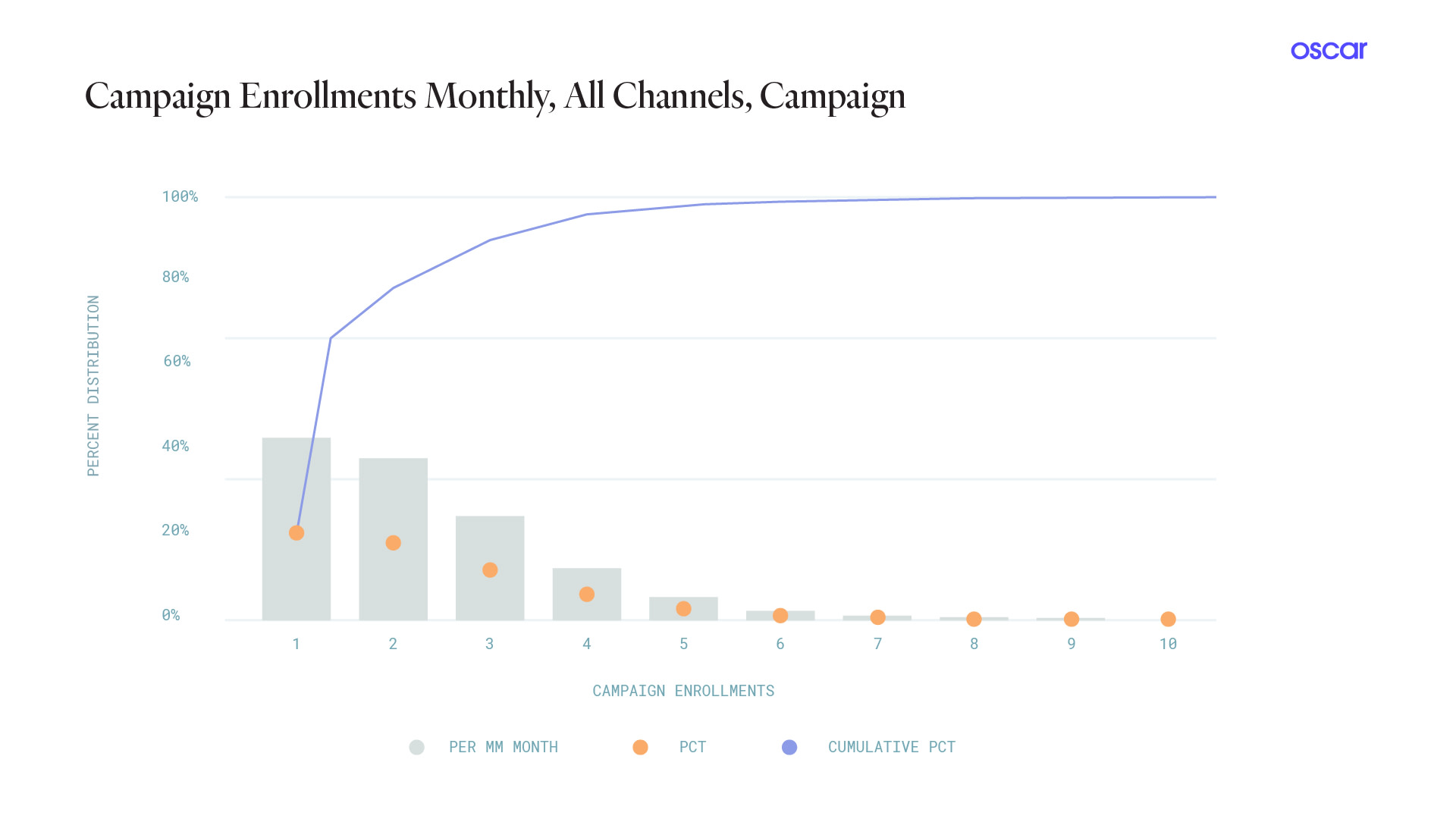

Campaign Builder Engine Our workflow tool allows us to quickly customize, test and optimize campaigns based on member behavior and preferences.

Campaign Builder Engine Our workflow tool allows us to quickly customize, test and optimize campaigns based on member behavior and preferences.

- Better Claims System

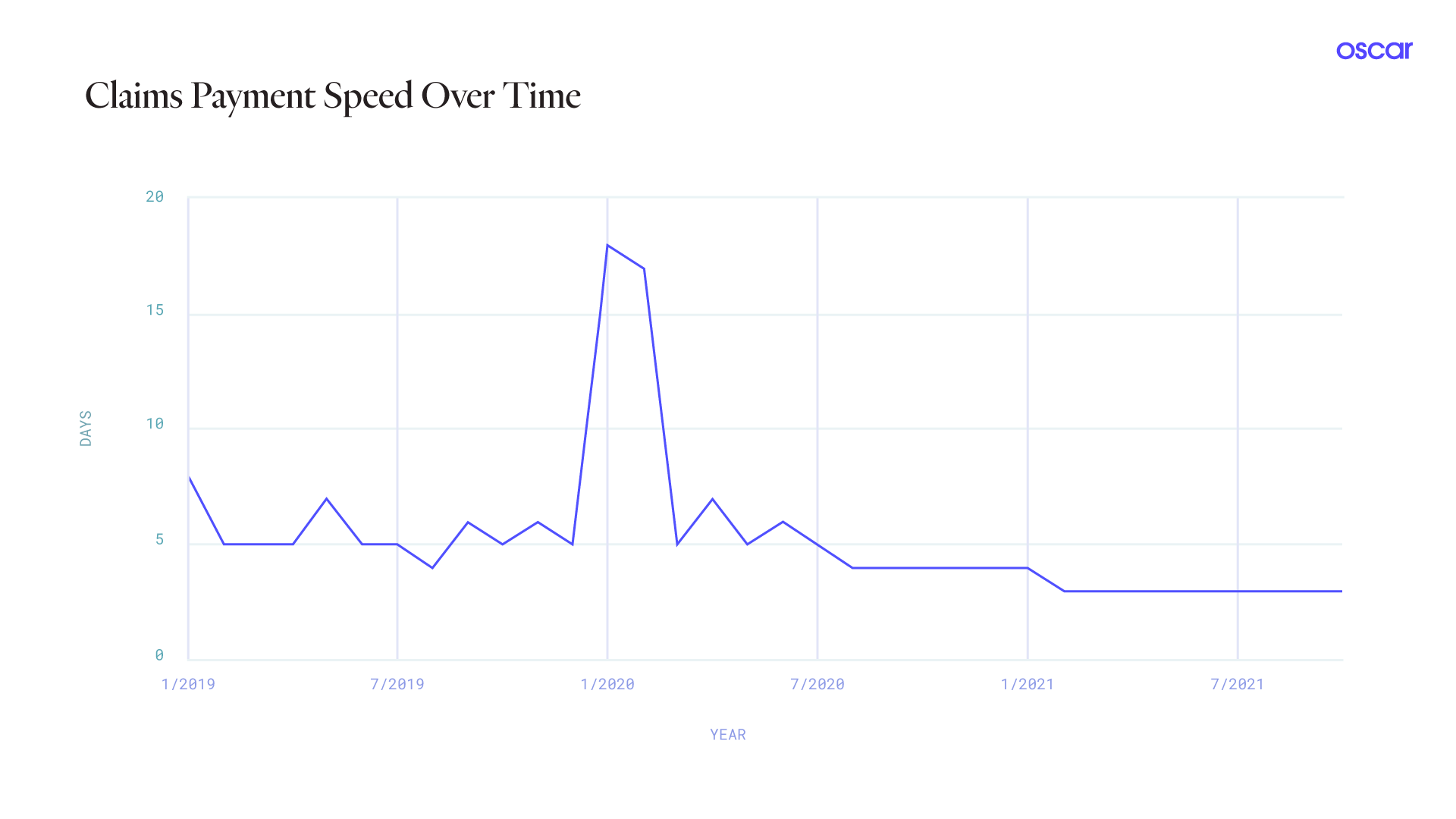

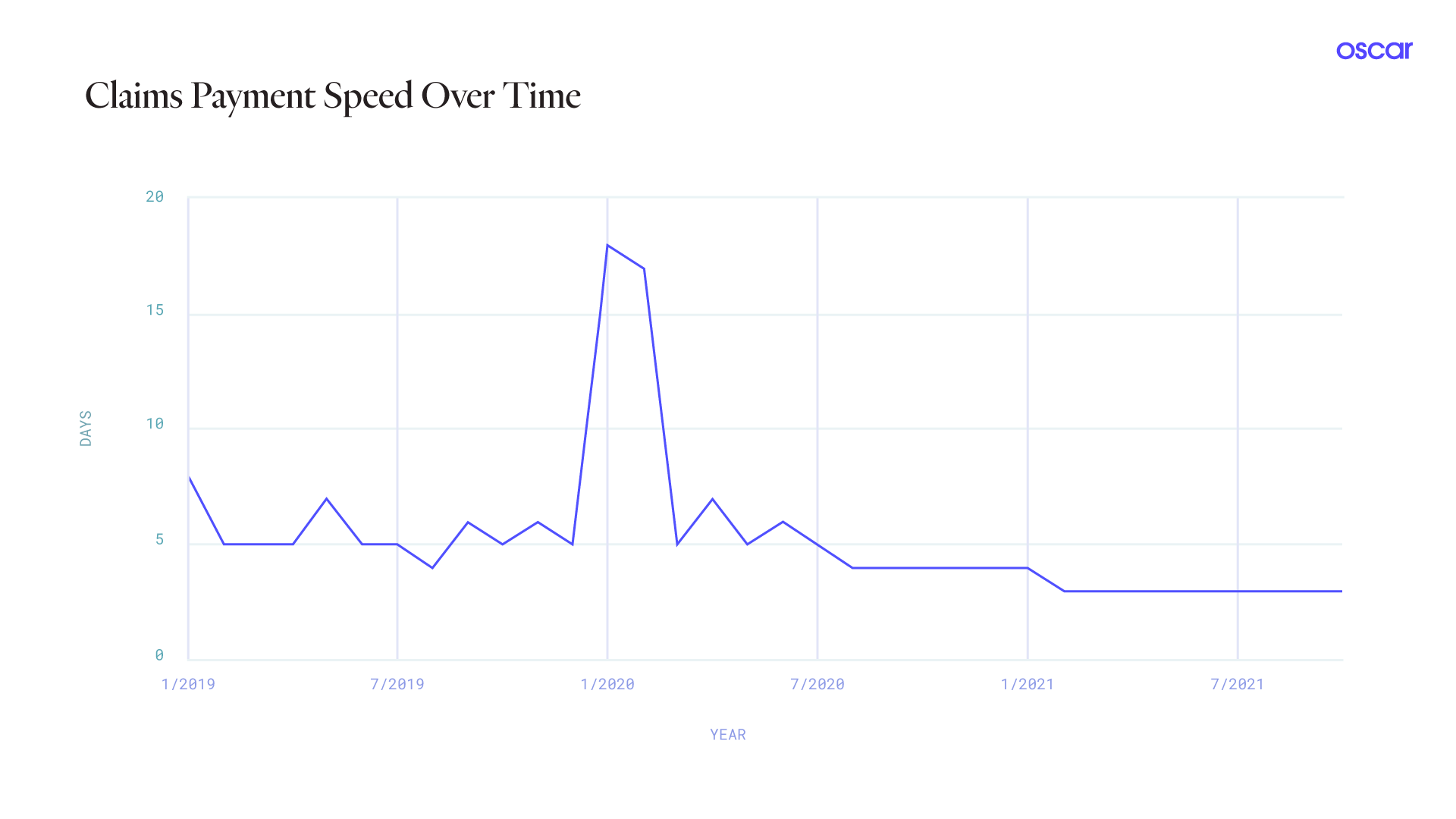

- Modern, Cloud-Native Core Payer Administration Solution Our offering lowers costs and drives efficiencies while enabling growth and innovation. The efficiency of our claims payments ensure speed and accuracy simultaneously, while building trust with provider partners.

- Note: The spike from January 2020 - February 2020 is attributed to the fact that we used to hold claims when we launch new markets to make sure we have no errors.

- In a pilot of 5,000 members, people who saw our total cost of care comparison tool while shopping were 2% more likely to renew their plan with us than those who did not see it.

- We see 84% primary medication adherence for Oscar Virtual Primary Care patients

So these are our versions of the core components of the “classical” health insurer.

However, in our view, we believe the best insurer is a “decentralized” insurer that builds these abilities as a tech platform to power others, not just itself. The classical insurer isn’t necessarily the most effective place to deliver the 4 core components discussed above. That is because other entities in the healthcare system (doctors, health systems, digital health players) are structurally better positioned to build risk-based, direct-to-consumer, longitudinal relationships than employers or B2B-focused insurers - which means that the classical insurer is destined to become obsolete, unless it evolves its capabilities and unbundles.